U-Shaped Token Curves + Stablecoins & Dollar Dominance

A post on how FDV is no longer a meme and emissions could create a true power law in crypto...and one on how the US maintains its dynasty without using the military (too much)

I’ve had both of these ideas written as half-finished notes for some time now. Bundling them together today as they may be half-baked.

U-Shaped Token Curves

Upon the launch of a given token (especially within DeFi) typically what we saw early last cycle was rapid token price appreciation as network values drastically outpaced any kind of inflationary dynamics (whether that be liquidity mining, investor unlocks, or stable token releases).

This launch allowed tokens to climb in value due to speculation before slowly deflating because of the lack of value accrual that was able to outpace any type of downward sell pressure, inflation, and liquidity flows. Some believe that this sell pressure is a kind of customer acquisition cost, effectively meaning that we utilize a given mechanism (a la liquidity mining) to distribute tokens to the community and “acquire users”, while another mechanism (selling at local tops) to distribute from weak to “stronger” and more long-term oriented hands.

As we saw this dynamic become more well-understood in 2021 post-DeFi Summer/Fall, we then moved towards a world in which a ton of tokens had “reasonable” market caps with absurd fully diluted values. In order to get around this crypto tried to decide that “FDV is meaningless” which at the time felt stupid to anyone remotely intelligent…but yeah, it was hard to try to talk to people about FDV.

But now we are 2 years and ~$2 trillion lower in market cap, and in my optimistic view somewhere near a bottom for crypto assets for the next 24 months1. As the market nuked, we saw emissions continue to chug along and now market caps are starting to trade closer to FDV and material token inflation rates/unlocks are entering their final year in many cases. This will ideally change the dynamic of multiple years of infinite sell pressure at a time where tokens have likely already transferred largely from weak to strong hands2.

So what happens next?

Awhile ago I wrote about how crypto returns could be less power law driven, with almost half of all tokens having a market cap north of $100M at the time. The driving factor of this hypothesis was due to the fast value accrual to teams, tokens as arenas for trading, a larger universe of buyers in this unregulated market, and lastly the open-source nature of these protocols.

With this in mind, the jaded view would be that we will see token emissions effectively dry out leading to either governance proposals to change tokenomics (if possible) or forking of protocols to issue a new token and start the casino game all over again.

However a less jaded view is that we might actually see crypto markets and return distributions start to mirror that of venture-backed startups instead.3

Perhaps, once we have a stable token supply (and in some cases a finite one) amongst leading protocols, we will see the power law begin to take hold within crypto. We will begin to learn that behaviors within crypto have been more cemented than we thought and that until material innovation happens to disrupt the incumbents in the form of more fully-featured products, better yield models, better UI/UX, or stronger tokenomics, the proverbial death by a thousand cuts on highly valued tokens stops.

This also ignores regulation enabling legal token value accrual, which if implemented, we will definitely see power law dynamics manifest in crypto.

The incumbent protocols could keep their position as major players and suck up the “enterprise value” of other tokens, reaching new highs, while even more sophisticated teams will recognize the need to evolve and expand to grow into their FDVs or sit at a given price, which as we know in crypto, only leads to sell-offs (cause crypto people either want the number to go up or they dump the asset).

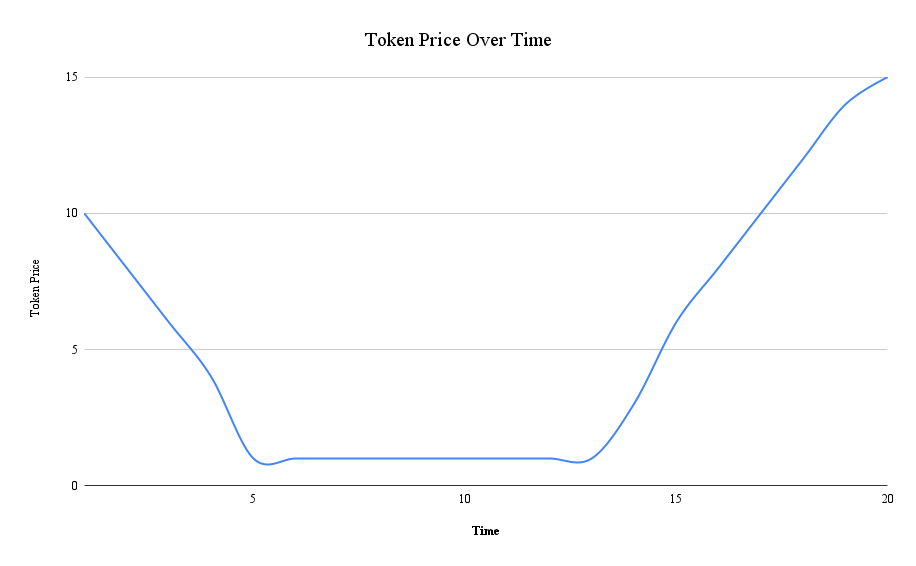

What we will then see is the natural evolution of second generation crypto projects (which we can define as those launched before 2023); a slow death for the majority of failed protocols, and a U-Shaped token price curve for the power law winners.

If we see the U-Shaped Curve take hold, we will likely begin to see new experiments run on token emission design in an effort to minimize the amount of time that the proverbial valley of despair, or the bottom part of the U, is in effect for tokens as distribution takes hold. The obvious way to do this is to slowly distribute tokens while making them non-transferrable, however it’s likely other experiments will emerge.

While there is a lot of design space to think about as it relates to this concept, including the pushback that until we get regulatory clarity nobody will ever want to own something like UNI for “governance”, my belief is that some of the pitfalls of crypto (mainly financial accrual without value creation) must be fixed.

Either way what I do know is that each cycle hopefully teaches us a new obvious-in-hindsight lesson, while unveiling structural truths within crypto. The U-Shaped Curve could be next.

Stablecoins & Dollar Dominance

There’s been a lot of chatter around tech world over the past year or two that at a high level could be summarized as “the US is losing power to China” and that paired with increased global tension amongst these two country’s allies could lead to some interesting implications for the future. The major implications of this are the US Dollar as a global currency being under attack and instead moving to a variety of other native currencies, or at a minimum, an erosion of power for the US without material conflict.

I’m not going to wax poetic on all of the next order effects that could come from a removal of the US Dollar as the de-facto base currency of the world, however it clearly is important for one the longest and largest dynasty’s in history to maintain its power.

There’s also an increasing narrative within crypto circles that one could think of the world as three separate governments in the future: Democracies (US and Allies), Authoritarian Regimes (China and Allies), and a Decentralized Collective (Crypto-natives and perhaps countries that forego central banks or increasingly have their leaders buy bitcoin from their cell phone).

While this may seem far-fetched, it does seem possible that more and more citizens could move away from wanting centralized monetary policy in a variety of countries and the digital economy could help make that transition easier for citizens of those countries as well as developed nations that nuke their wealth because of what their Fed Chairman says to the media on a given weekday. Of course, we all will want to get back to some form of fiat for a variety of reasons as even I am not a crypto-bull enough to believe in the next 20 years we will be using decentralized currencies only.

This brings me to USDC or stablecoins generally. Ignoring all efficiencies that are created by stablecoins in the financial system, while many governments could worry about crypto reducing their power, it’s clear to me that USD being the core peg for stablecoins is net beneficial to the US in some version of this new world4. Across crypto circles, many international holders discussed how their most profitable trade in 2022 was the fact that their stables are denominated in USD and not their native currencies (GBP, AUD, JPY, etc.) that were heavily devalued and many others in emerging economies have touted stables as a literal financial lifesaver.5

On some time horizon the government will need to actually address stablecoins and adopt them in a centralized way, but also it would behoove the US to be very pro-stablecoin even in a “decentralized” way as long as they are properly collateralized to an extent. If the global power of the US Dollar is to come under pressure, owning the base crypto to real world peg is immensely valuable, even if just as a call option for a future you don’t fully believe in.

More precisely, I don’t believe we get sub $1k eth again in that timeframe

Or from Alameda to regulators.

For what it’s worth, I say this, but there is an entire other post to be written about how stock based compensation is the same as token inflation.

And we can argue the different versions, but imo it is inevitable that some form of it takes place.

There are of course protocols trying to do stablecoins that aren’t pegged to the US Dollar but instead the Euro or JPY, but they are effectively irrelevant for now.