Timing IPO Windows

Why the small number of IPOs in the past two years suggests tech companies are moving far too slow in identifying IPO windows and are repeating mistakes from ZIRP

I have made it a point to take notes of top signs. This post is contributing to that list.

A number of founders and investors in the aftermath of the 2019-2021 era for startups/tech markets quietly wished they would have capitalized on the cheap cost of capital and liquidity provided by public markets at a greater rate than they did.1

Many vowed to never make that mistake again.

Over the past 36 months, many c-suites and boards have said that they were holding off on going public (or readying to go public) until the market was able to receive them and the “IPO window was open.”

Some believed this to be a market demand problem, due to low multiples after aggressive rate hikes in 2022 reset the sins of ZIRP valuations, leaving the market disinterested in mid-growth, unprofitable tech companies.

Others called it an unwillingness to swallow a bitter pill; a commentary on the reality that a bunch of companies raised at too high prices and thus needed infinite a lot of time to grow into those valuations and not set off the cascading effects that result from a high-flying company becoming a “good not great” outcome.2

For a moment in 2022, amidst the uncertainty, this made sense and there were few liquidity and inexpensive financing options for startups. However as markets stabilized into late 2023 and future rate cuts seemed evident in 2024, paired with ChatGPT effectively restarting capital markets and an AI/capitalism boom, it became likely that there could be public market appetite for tech over the coming 12-24 months. And from November 2024 (post-election) onward, it was consensus that we would have a window in the coming years.

I could show a bunch of charts that prove these points, but I think everybody knows generally that multiples are slowly marching back towards 2021 levels, markets are at all-time highs, and there is a fervor that qualitatively and quantitatively shows a variety of new story-seeking and risk-seeking behavior in public markets.

The world is oriented towards max speculation.

And yet, it feels like few companies are prepared to go public and put themselves in a position to seize this window either out of ignorance, negligence, or risk aversion. But similar to my beliefs on investing, when it comes to finding liquidity windows, it is better to be early than late.3

In a world in which markets cycle quickly/aggressively my thoughts are two-fold:

All growth-stage companies should begin preparing for an IPO once they reach some level of commercialization that makes going public a realistic possible outcome. This means they can “flip a switch” and get public within 6-12 months.4

Projecting IPO windows is a complex task and perhaps fool’s errand, and also an exercise worth attempting.

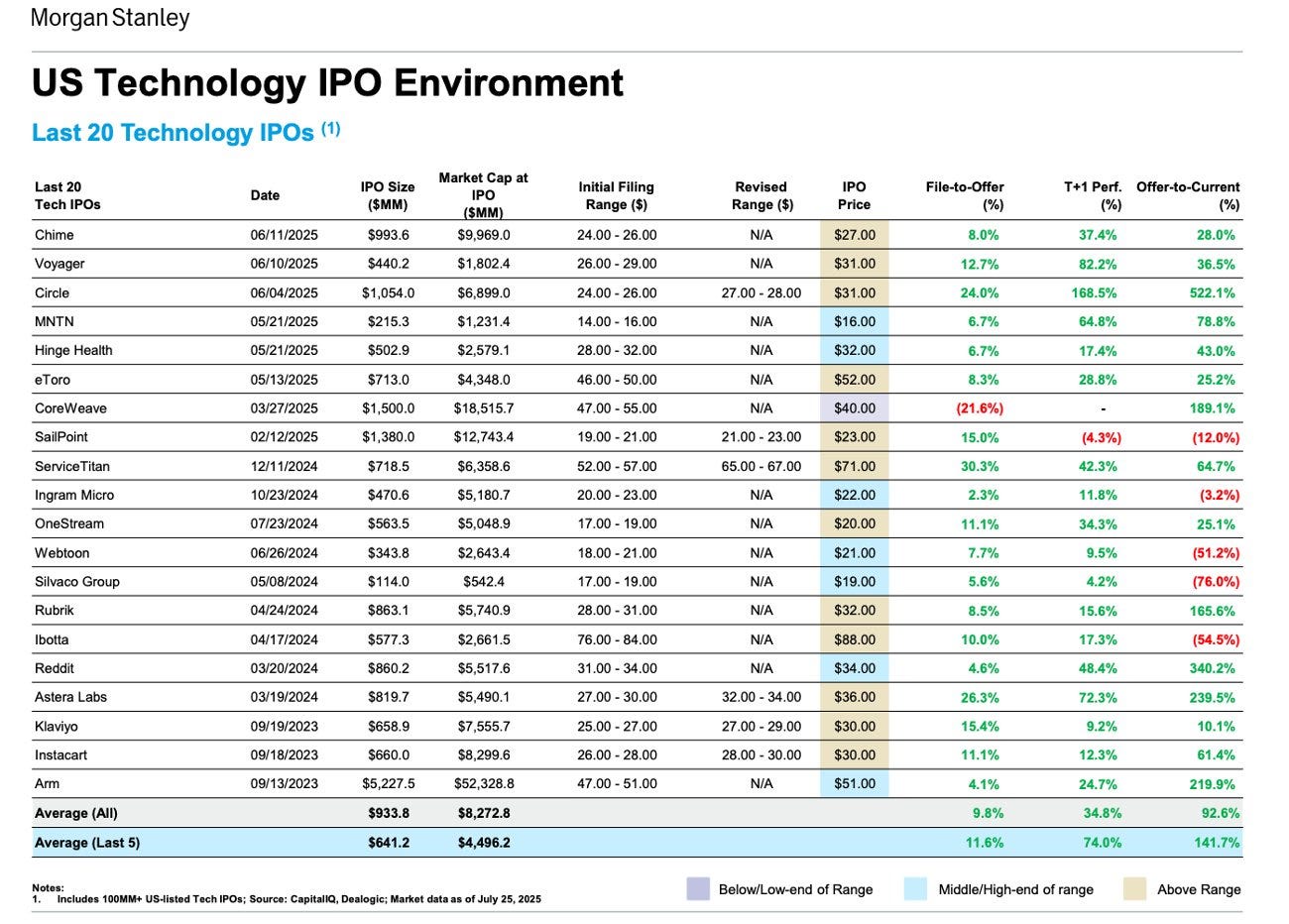

The one piece of supporting data I will show for now comes from a tweet from Jeff Richards, which shows the IPO performance over the past 12 months for a variety of companies that decided to run through the window first. The performance is quite good.

I believe we will see a continuation of this trend with Figma, in which there is rumored to be massive oversubscription to the IPO.5

Capital Rotations & Seizing Windows

Assuming we have done #1 (prepared for IPO), we then must try to understand #2 (timing a window).

Many investors like to look at capital rotations as Rorschach tests on market psychology and appetite for different types of assets. Since the “AI boom” began, the majority of returns concentrated across Mag7 stocks, with the Mag7 outperforming the Nasdaq and S&P by ~1.8-3x from ChatGPT’s launch date into the 2024 election.6

This could be due to fundamental reasons (they were clear first-order beneficiaries and owners of core LLM breakthroughs)7 and due to their narrative legibility, were the “best ideas” that could accumulate dollars hunting to play the AI Rotation.

This trend would suggest an improving world for tech stocks but one which is perhaps not evenly distributed and would be less excited by anything with less scaled and legible quality (as Mag7 fundamentals are sans Tesla) or highly levered to AI.

A perhaps tenuous IPO window.

But with a regime change in Washington, so came a regime change in risk markets.

If we look at markets from the point of the inauguration of a very (in narrative) pro-business administration8, we see the signs of meaningful shift in market behavior, with narrative-oriented non-profitable, theoretical high-growth stocks outperforming the Nasdaq and Mag7 by 5x+, suggesting capital sprinting out on the risk curve very willing to allocate to speculative stocks across a breadth of sectors (eVTOL, Lidar, Space, Defense, Crypto, Software, etc.).

This could signal an open IPO window, which again, a small set of companies timed well across themes, including Rubrik (data security with strong revenue scale but poor profitability, filed ahead of this in April 2024), Circle (thematic crypto company arguably poor fundamentals, filed April 2025), and Figma (software with loose AI narrative and strong revenue scale, filed April 2025).9

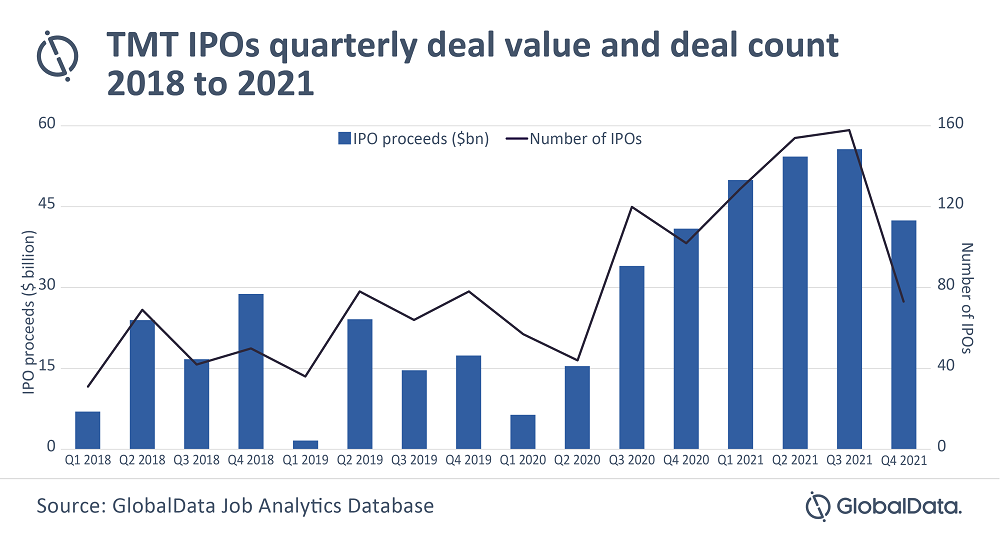

We saw a similar pattern before in 2020-202110 in the COVID to post-vax market where IPOs again spiked as speculative indices peaked in their performance above the Nasdaq, S&P, and Mag7.

The question on a go forward basis is whether we already saw the crescendo of this moment with the Opendoor 100% intra-day move on a short squeeze, signaling an “end times for max speculation” top, or whether that was the market begging for new, quality companies with potential for high-growth to invest in.

A subject for another day.

Why Liquidity Matters aka What’s The Point

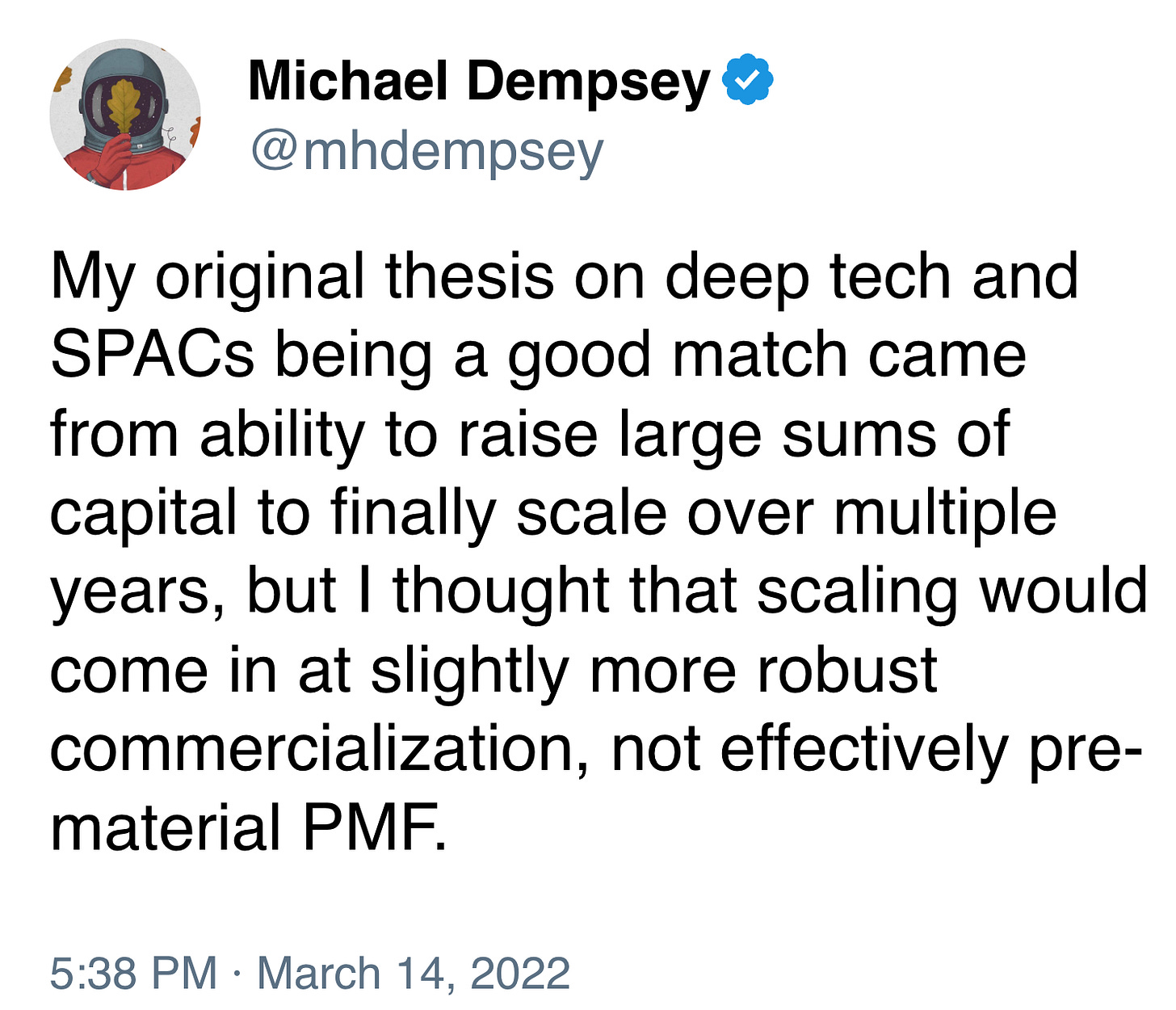

In 2021 and 2022 I loudly made the argument that the mechanism of SPACs were interesting but were naturally abused by people shoving companies into public markets that were at best unprepared and at worst total frauds. Some of these companies used the resulting cash pile to survive and have come back, while others rightfully have passed away.11

I am once again making the argument that these moments in time, while feeling increasingly common are still rare and can be used as offensive weapons for companies (ideally fundamentally and/or narratively strong) in a tech industry in which:

The barriers to competition are falling

Consistent liquidity is as important as ever to hire and retain top talent

There are massive potential company enabling and destroying technological inflection points lurking in the future.

Private markets are increasingly searching for a small number of specific assets at growth stages (AI labs, AI hypergrowth companies, Defense/Reindustrialization companies) while public markets are showing a large willingness to bid across the spectrum.12

A huge number of valuable companies have been private for way too long.

As I said, this is likely a post that will mark some sort of top, but with each passing day I can’t help but wonder if many in the tech industry are making the exact mistake they swore they wouldn’t make again.

The IPO window has been open for almost two years now. My hope is that many will use public markets the same way they use private markets; to effectively raise capital from optimistic believers in an effort to grow into their future valuation and build the future they believe in.

But shout out to all the VCs who infinite-dumped almost-dead companies as SPACs on retail, we know who you are

CEOs → VCs → LPs all take hits in different ways financially and social capital wise

Especially with 6 month investor lock ups

This is the part where CEOs, Bankers, and more yell at me telling me I am naive about how hard it is to go public

And to be fair, Figma of all companies is the one who really should understand the value of timing markets and liquidity. Happy for them.

ARKK is a bit odd vs. Mag7 as both include TSLA

MSFT as a proxy for OAI

Who repeatedly screams at the Fed chair to cut rates

I am intentionally leaving out Coreweave due to it falling under the very legible AI narrative bucket

You know, that time everyone wishes they had taken their companies public.

And tbh, it’s not clear if you’re some flailing AI lab you also shouldn’t try to go public, as Finn mentioned here, and I believe some may try to do in the latest of innings of the bubble. I do not endorse this but markets will market.

Besides Bio (so far)