The Importance of Founder Pedigree In Emerging Technologies

When, why, and how founder pedigree matters in startups before and after major technical breakthroughs.

This post originally was published on my personal site. Read the full piece with footnotes there.

Feel free to retweet here.

When an area becomes consensus but is still somewhat novel or hard to parse for investors, they often try to distill companies into very clear-cut and easily "findable" metrics in order to make decisions.

In many cases, this wave of chaos, rapid change, and complexity pushes investors to retreat into discussing a constant in startups; Founders. And as one searches for Founder-Company fit, they then anchor on the next clearest signal; Founder Pedigree.

In technologies that are Pre-Breakthrough or Cambrian Explosion moment this framework feels valid.

Investors are looking for those responsible for changing the world and doing something that has never been done before, and as those people seek to commercialize their breakthrough, the idea is that nobody understands it better than the original “inventors” and the inventors will be necessary to push it from a research breakthrough to production-ready as a technology.

As an industry shifts from pre-breakthrough to post-breakthrough, high-pedigree founders are able to raise staggering amounts of money, capitalizing on investor narrative distillation and hype cycles. We have been seeing this within AI over the past 24 months, as we live in a post-Transformers and post-GPT world, with most of the well-funded AI Labs and companies being founded at first by the original authors of Attention is All You Need, and now with a second wave coming from those early on at these larger labs (or those who were senior hires for short periods of time).

This secondary dynamic is not a rare one in the 1-2 years after a breakthrough as the incumbent monolithic feeling entities rise massively in value, creating golden handcuffs for some and parachutes for others. The early employees then often look at the nuanced disagreements they have with their incumbent approaches and candidly have the confidence to go out on their own, and leap into the founder pool (resulting in the second wave dynamic above).1

However, as a given space’s breakthrough(s) becomes well-understood, investors tend to overrate the rate at which the people responsible for the breakthrough will be able to take a given technology towards a scalable product or down a cost-curve while navigating the idea maze of commercialization and GTM. Those responsible for a given breakthrough may not be best suited to figure out how to innovate & capture value as founders, though it is likely they will be incredible team members.

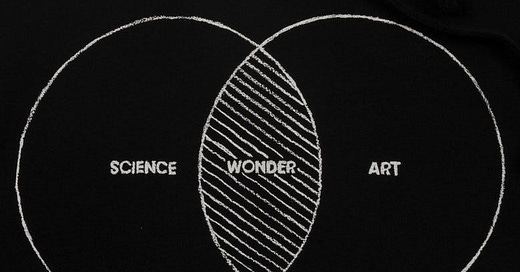

Thus as a founder and investor, the key thing to understand perhaps is the rate proliferation of “key” knowledge in a breakthrough area and how much that knowledge compounds internally versus at an industry level.

The canonical example in AI is the thought that a year ago people would say there are ~50-100 people in the world able to train models at the parameter size and scale of GPT-4. That number has greatly expanded on the infrastructure side and will continue to expand as people adapt Mixture-of-Experts approaches and less reinventing of the wheel happens on the back-end.

To finish reading this piece, head over to my personal site.

Or these things happen at big companies and the leaders fracture in ambition or sequencing and both leave. This is arguably how one could describe the origin stories of Nuro and Aurora in the autonomous vehicle space.