The First 40 Months

Why founders should precisely understand what milestones are needed through their first two rounds of fundraising instead of sprinting from round to round.

TLDR; Though it feels like a fool’s errand, founders should hypothesize and model their first two rounds of milestones when raising initial capital.

Despite what we may want to believe, if one were to re-simulate a company's path and lifecycle from year 0 to year 4, that path 6-8 out of 10 times would be different.

This is not a commentary on the often held belief that founders pivot heavily across ideas early on (some do, I believe this happens less often than we’d like to admit) but it instead is a commentary on the somewhat random walk of capital and talent markets for early-stage companies and how they impact the slope of company progress.

This random walk means there's a lot of divergence that happens in the first 12 to 24 months when a founder raises capital across engineering milestones, product velocity, investor interest, hiring pace, and much more.1 Because of this, there's a tendency to believe that a lot of how we should think about raising capital at the early-stages is in sprints around each round of financing, building from one round to the next.

Once again, common wisdom and startup lore would tell you that rounds should be done in these sprints to prove discrete milestones that are legible to investors and that it is a fool’s errand to try to do anything but look one round ahead.

Simplistically this has created a path that looks like:

Pre-seed / seed :: gradient of MVP to early commercialization of v1

Series A :: scaling commercialization

Series B :: Scaled PMF and moat building

Series C+ :: product/category/TAM expansion

Series D+ :: Dominate first act of company and begin executing on second act / Make the math work for multi-billion dollar funds to foie gras your startup and for people to sell secondary (kidding sort of).

The New Fundraising Path

Startups are in many ways about building long duration rising tides that crescendo as step function milestones.

Inside of companies this feels anything but a smooth path, and externally investors have often been able to filter out the messiness to draw conclusions about these step functions. While in some ways this is still true, investors today increasingly are backing momentum over step functions due to the uncertainty of where the reshuffling of the technology cards via AI may lead us.

Financing markets have thus changed, with company type influencing investor-driven milestones heavily.

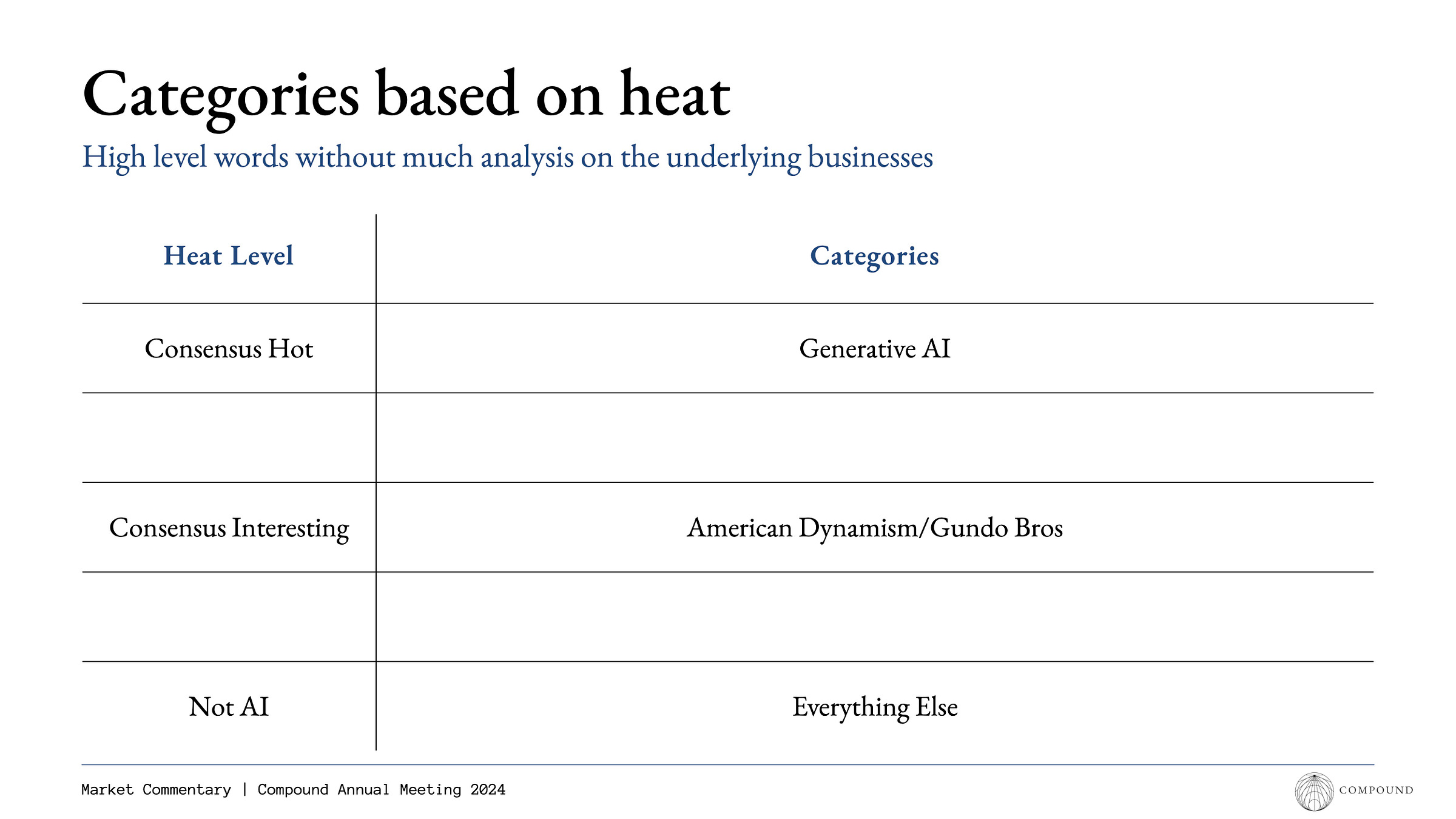

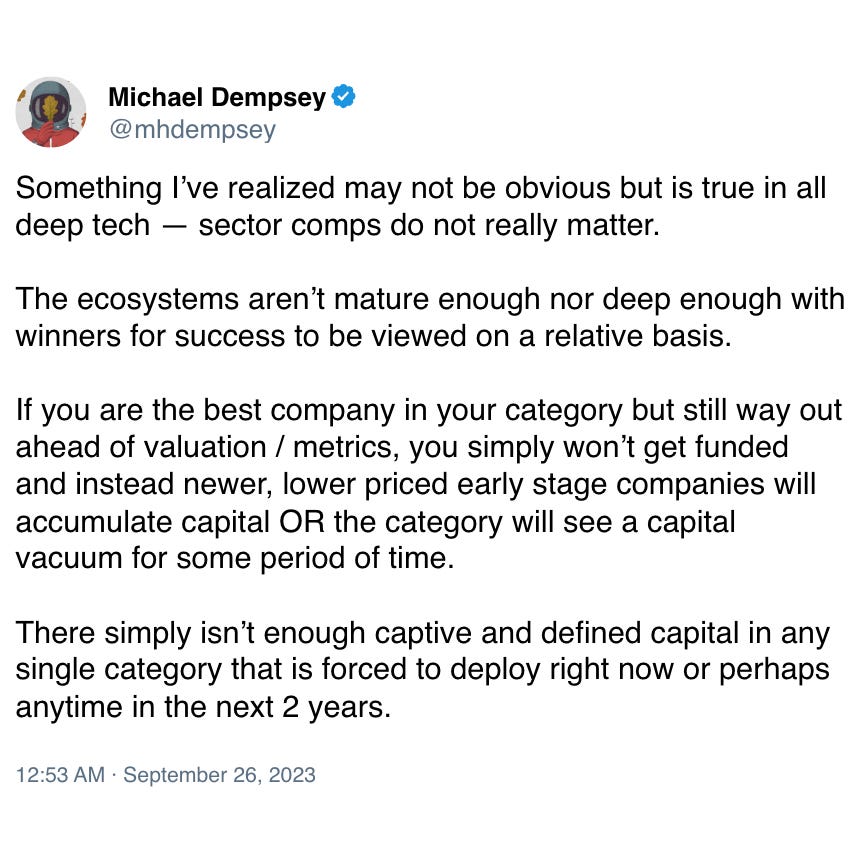

Startups have always moved between gradients of investor optimism, however these days it is now a hard line of haves and have nots in financing markets. This is due to the rapid pace of conviction cycles in venture as well as the overly-discussed reality that AI has sucked the air out of the room of all startups.

These two images from our 2023 AGM and 2024 AGM are my most simple distillation of this point.

Relative to the above path, today rounds in AI might look more like this:

Pre-seed / seed is now just “unknown universe investing”

Series A :: Team + MVP + minimum viable commercialization

Series B+ :: A fuzzy view on how capital can create a kingmaking dynamic within a given category. (more on this for another post)

This pushes milestones to effectively be “how do we build a narrative and align metrics to be 1 of the 3 companies in (insert AI company type) that warrants a $30M+ financing round at $2-$10M of ARR, which in reality puts you on the path to raise capital every 6-12 months for the next 2-3 years before competitors (or you) thin out as cohorts mature and struggling-but-well-funded companies pivot into your space.

One could deduce that the only thing that matters is thus, how can an AI company get to Series B?

Two financing rounds of thinking instead of one.

In non-AI software companies we have a different story.

If you are commercialization oriented then the bar for raising capital continues to be immensely high as dollars into your company are largely viewed as dollars not going into a hot AI for legal/codegen/finance startup.

I’ve found this point often does not quite land as historically we have thought about startup investing as relative siloes of capital based on company type or vertical.

Companies building in areas that carry large technical risk and longer GTM/commercialization timelines have always struggled with crossing the chasm in which they de-risk these two points and thus their investor universe increases. Typically this happens at Series B and has historically required raising from certain pockets of capital (aka “deep tech funds”) at the Seed and Series A from investors with meaningfully different views on the risks they are willing to underwrite.

Today, everyone is in theory a deep tech investor2 and even worse the milestones to get a round done are less clear than ever before. The burden of proof on the founder thus varies based on the current micro hype cycle around their category, the investors’ conviction in the given space, as well as how AI and/or reshoring-pilled a firm is.

Neurotech in 2022: Dead on Arrival.

Neurotech in 2025: Show investors a paper and a dream.

SynBio in 2018: Saving the world.

SynBio in 2025: Please explain to me exactly why this won’t take $300M more and eventually end up a low-margin commodity business so that I can pass and wait for the bridge when Series A/B investors balk at underwriting both technical and financial risk.

Robotics in 2022: Feels capital intensive. Pass.

Robotics in 2025: Humanoids are actually a bigger market than LLMs.

I could keep going, but I won’t.

While many will give flowery advice like “just go heads down and build and don’t try to worry about the future markets”, this backdrop means that when raising your initial round of capital, the sprint methodology may no longer make sense.

It feels optimal to have a view not on the first 12 months or 24 months when you go from initial capital to next round (Pre-Seed to Seed or Seed to A) but instead founders must model how to reach the theoretical milestones to reach a breakaway point and/or momentum point (PS→Seed→A // Seed → A → B), having a hypothesis and understanding of what your first 40 months could look like.

In those 40 months you will be able to expand the universe of investors, accumulate talent, and show both execution and momentum. You're going to have built out the early signs of a core team, technology, and/or product, begun to understand what trajectory and path your company is on3, and perhaps most importantly if not at hyper-growth, how legible your narrative/company will be to investors and their floating conviction/interest levels.

An apt analogy is perhaps that raising capital for early-stage startups is now too about thinking step-by-step and scaling reasoning through test-time compute.

More simplistically, before investing, investors at the earliest-stages want to know that they are not sending a company into a financing market buzzsaw due to poor understanding and multi-step reasoning.

While this may seem like a fool's errand, hypothesizing milestones across the first 40 months (and thus 2 rounds of funding) is important not because you’ll be perfectly correct, but because you'll revise and iterate upon your 40-month plan in month 4, 8, 12, 16, and 20 (when you are fully executing on whatever is needed to raise your NEXT round in month ~32).

The Meta of Financing Markets

ZIRP and the years leading up to it taught us a lot about how to game financing markets to enable founders to effectively course correct their narrative within a 3 month window of financings. The best founders realized how valuable it was to understand the current and future metas of financing markets.4

Today, at a time in which a small subset of companies are garnering the vast majority of dollars, it’s important to recognize that in most cases founders can no longer sprint with their heads down, pop up, and mildly adjust the story and metrics in the quarter prior to a fundraise.

And it has material implications for how founders and investors should think about fundraising as well as goal-setting across multiple rounds.

Hiring sometimes is opportunistically great, and other times surprisingly difficult. Capital sometimes is high momentum leading to pre-empts or excess capital via SAFEs, other times its scarce. Sometimes a pandemic freezes capital markets, other times ZIRP accelerates it, etc etc.

Kill me.

Bridge/Post-Seed, Good Seed, small Series A, big Series A, etc.

We are seeing this now with how people game ARR and growth, largely in AI