Get Rich or Die Tryin'

How a psychological shift in wealth creation, risk/reward appreciation, and There Is No Alternative will lead to investors bidding farther out on the risk curve faster than we think

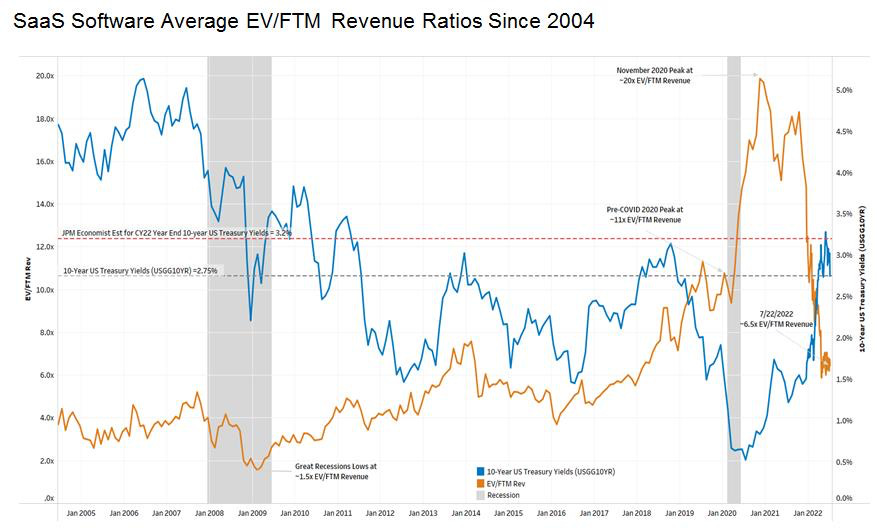

It is now somewhat common knowledge that as interest rates rise and the economy tightens, investors are less willing to go further out on the risk curve. We see quick sell-offs in crypto, private market multiples compress, and down the risk curve it goes until your favorite public SaaS company is down 80% in a few months and notoriously high DeFi lending yields can’t outperform treasury bills.

And then slowly but surely, we assume interest rates get cut1, multiples expand, and we cycle through this all over and over again (with “lessons learned”…and then forgotten at the peak). Typically this walk further out on the risk curve can be over multiple years, a slow and steady build of momentum and risk tolerance. Of course now, different assets are viewed on different parts of the risk curve. As I wrote about in my post Speculative Bubbles in the 21st Century & Asymmetric Upside, the broad understanding of asymmetric upside by investors has forever changed investing in canonical “risk-on” assets.

At the same time, in this country and most others, we are seeing a dispersion between the upper class and working class, with an ever expanding wealth gap. Part of the shift I mentioned above was correctly about understanding the expected value of “asymmetric upside” investments, however it also has been about a psychological shift for a new generation of investors from millennials down to Gen Z/Gen alpha, and whoever comes after that until we have some form of Universal Basic Income.

Prior generations (Boomers, Gen X, basically anyone ~50+) were born in a world flush with pensions, social security, and an approach to linear wealth creation that guaranteed the American Dream. Within this timeframe, the concept of indexing and John Bogle’s methodology of investing proliferated, leading to large scale wealth growth via mutual funds and then a barrage of ETFs.

Current generations (Millennials, Gen Z, etc.) were born in a world with multiple bubbles (2000, 2008, 2021), a couple of wars, a global pandemic, low wage growth, and perhaps high inflation. Also they have Robinhood and Coinbase.

The Social Network and the broader publicity of wealth creation via entrepreneurship/private markets taught us how to survive in this new world. A world where non-linear wealth creation is the only way to make it. Whether this is true economically or a fever dream that has been proliferated through social media, these generations' social values align with a Get Rich or Die Trying mindset (I think I just dated myself with that reference).

Or put another way, I believe investors in these cohorts will utilize a barbell approach to risk as they mature in a way that prior generations have not.

What does this look like in practice?

As we begin to see real wealth transfer from prior generations to current ones, and as we see all the above-mentioned negative catalysts settle in for the average person, how risk curves are bid will change.

The power of indexing (done via robo-advisors and the same barrage of ETFs) will not go away as the meme is too strong and active management is too heavy of a lift for most, however the change will happen in how, when a market goes “risk-on”, people spread their allocations.

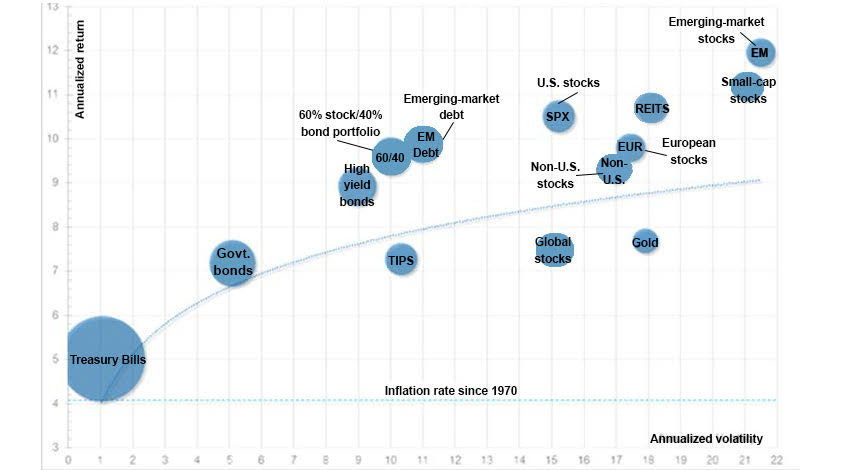

The prior paradigm had the vast majority of capital being sucked into “risk assets” of VTI or other market indices tracking the largest, most “stable” companies, promising annualized returns somewhere between 5-9% (inflation adjusted), paired with a blend of growth, small cap, and international companies, promising returns on the upside of 7-13% (these aren’t precise numbers).

The new paradigm will still have large indices that exist via the Infinite Bid in 401ks etc. and stale investing advice, however >1 beta equity assets for retail will likely be skipped in exchange for high-risk assets like crypto, private investments, and more2.

Within these buckets you’ll have effective indices (BTC/ETH), growth (private market investments + funds/SPACs god forbid), and speculative bets for those aggressively chasing the dream of non-linear wealth creation (altcoins). Over time, as these markets mature and can absorb institutional liquidity at scale this will change and returns should compress, however this is not the point for writing this post.

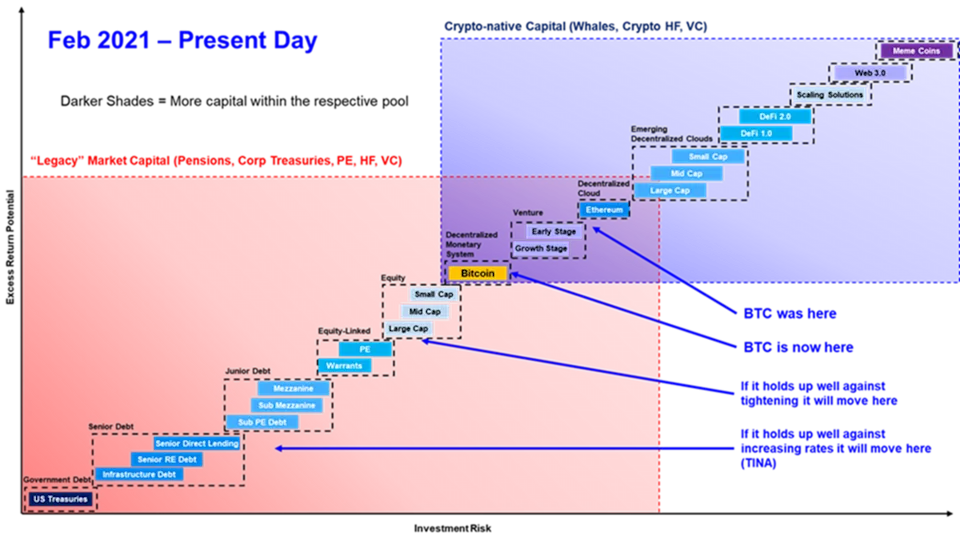

Despite all the over-writing done above, my main point is that in this next market recovery, I believe alternative assets like crypto (and in some way early-stage tech) will recover far faster than we typically see as investors run and skip out to the farthest points of the risk curve, leading to risky assets accumulating capital rapidly, while others continually suffer and see underperforming multiple expansion.

On the other side of my point is also the argument for TINA, a concept that stands for There Is No Alternative, which multiple fund managers have made the case for over the past ~6 months and basically states that risk assets like BTC and ETH can replace fixed income assets. While this also seems plausible, I am arguing as much for a lack of returns to be found as I am for a psychological shift in market participants.

A shift that starts with this generation’s investors, and likely ends with a massive dispersion of returns, and the return of Alpha in a market that has largely benefitted those chasing Levered Beta for the past decade.

Because that’s where we are in modern monetary policy, one where we always want low interest rates over high ones.

It’s not clear that these assets in later stages of bull markets don’t eventually just evolve into levered beta, but at early stages of up-cycles my bet is they will have meaningful alpha dispersion.