Full-Stack Deep Tech Startups & AI Value Capture

On building full-stack companies at a time when many are loudly doubting startups capturing value in AI

There are a few views (both opposing & complementary) that many people hold today as it relates to AI and startup value capture that are important to outline ahead of this post:

AI investing will be a wasteland as startups are destroyed seemingly monthly by the Frontier Model providers like OpenAI and the hyperscalers. This take is particularly boring to me as it shows a lack of creativity and inability to think differently at all about how the future could be different from the present.1

AI will be much like mobile and other prior horizontal technologies in the sense that it will eventually create startups that capture value in ways we never could have imagined. This is likely directionally correct but it’s very unclear how to take action against this view besides to continually try to back things that look weird and novel (easier said than done). This view is realistically manifesting itself as a spray and pray approach across many large VC firms who can lose chunks of $2-$7M with little consequence, with the weirdness being a very tiny percentage of dollars being deployed.

AI will disrupt and enable a variety of incumbent industries. This is consensus and obvious, however carries nuance that is important to unpack.

—

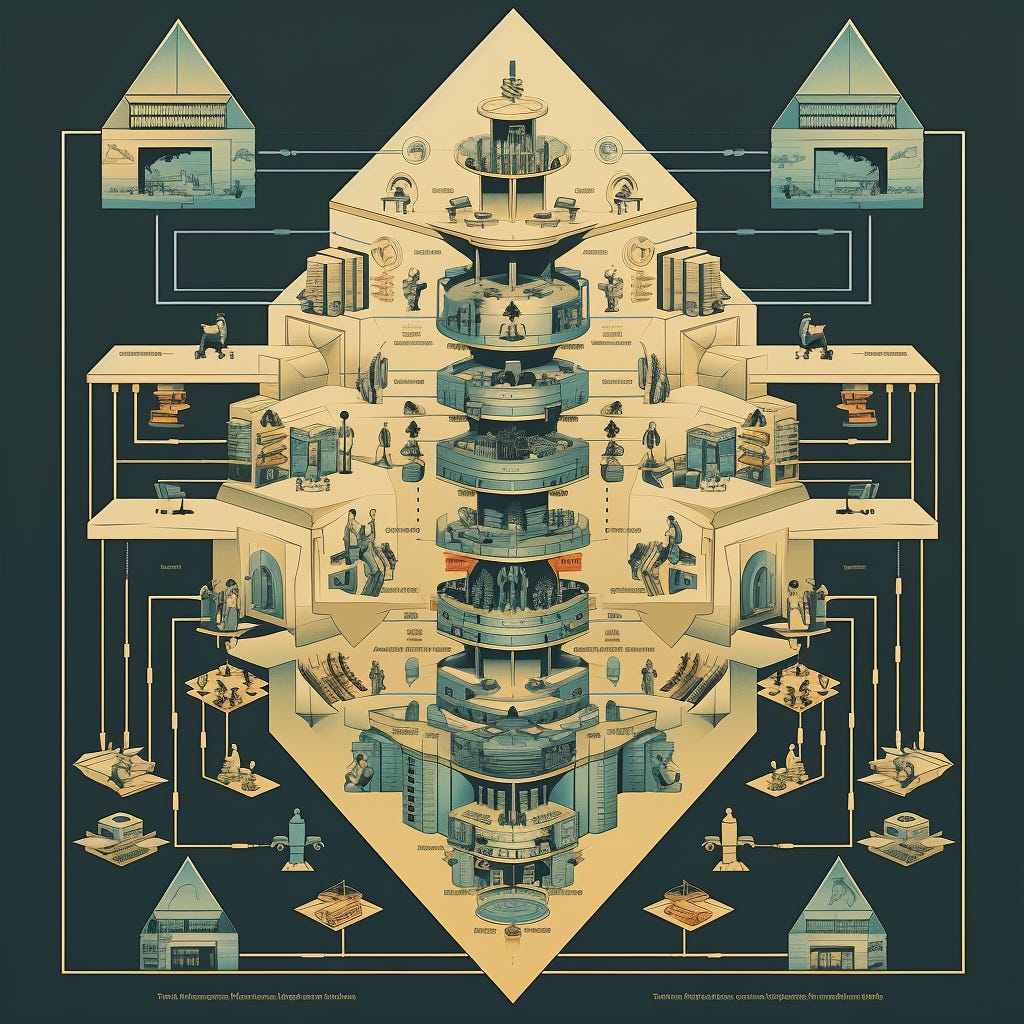

As the collective investing world continues to very loudly doubt “thin layer” AI software startups and their ability to capture long-term value or outpace functionality/ROI of GPT-X, there’s another strategy that I think goes under-appreciated within AI today. The full-stack startup.

Chris Dixon, A16Z, and Cantos have unpacked full-stack startups in the past, but our focus on full-stack startups at Compound are those that not only build/adapt transformative frontier technologies but also deliver the ROI themselves.

These companies are especially compelling in deep tech, as they can deploy not-yet-fully-scaled tech with the help of existing systems or even human intervention.2 This allows them to efficiently iterate, gain customer feedback, and navigate the often more complex idea maze.

The canonical example of this is SpaceX, which crashed multiple rockets while creating value by getting things to space. In On Inflection Points, I talked about SpaceX as it relates to Domain Progression inflection points:

“The important part to understand when building a company that takes advantage of domain progression is the scalability and transferability of your technology over time. While SpaceX can innovate over time, improving the economics of their first domain (launch services), eventually reaching scale to invade new domains, there isn’t material wasted R&D that doesn’t capture value along the way, as each innovation improves their core domain use-case.”

Within our own portfolio, companies like AIFleet in trucking, Shadows in AI-enabled animation, and Ono Food Co.3 in robotics-enabled food service, have all benefitted from this approach, among others.

While short-term the learning feedback loop and sales cycles often are shorter relative to B2B2B companies, what’s most intriguing is that these companies are able to long-term build strong moats and capture larger parts of the value stack versus more narrow point solutions that VCs typically swoon over.

However, many investors quietly are unable to build conviction investing in full-stack startups in many areas.4

One reason for this is many believe there are upward bounds on the size of these companies.5 This is perhaps true, but our belief is that tech-centric versions of companies enable them to be significantly larger than the largest incumbent. Founders and investors can look at market sizing, technical competence of said market, and fragmentation as ways to properly understand the opportunity.

The main reasons though are that these businesses are often lower margin (and thus will get lower multiples), more operationally complex, and often more asset-heavy. They fly in the face of the software business model that everyone loves to say is the greatest business model ever invented.

At Compound, we tend to believe that startup difficulty doesn’t scale linearly with complexity, and in fact asymptotes. Put another way, all startups are hard and likely to fail, so you should build one with the largest scale of ambition and value capture that you believe in.6

One of the core traits of deep tech companies is that they create market cap destruction and expansion, in part because they are literally doing things that have never been done before. These breakthroughs are inherently disruptive and paradigm shifting, but also they usually are creating powerful leapfrogging dynamics and eroding incumbent business models.7

While many today are going the more obvious path of selling AI-enabled software into a wide variety of industries, we are left wondering if the optimal venture-scale business is built utilizing breakthrough technologies for consolidation and verticalization in these early stages of the paradigm shift (a la Amazon) before the eventual end state of technological profileration which results in an “arming of the rebels” (a la Shopify).8

This looks like going industry by industry, understanding where inefficiencies around utilization, margin, labor, NPS, and scale exist and deploying more advanced technologies over time while also likely shifting incentives and compensation structures within these orgs.9

There are a variety of people looking at this now in the professional services areas and I imagine in the next few years this will be the new MBA Search Fund idea that becomes en vogue (like buying a hyper-narrow vertical SaaS business or “SaaSifying” an old business has been the past 3-5 years).

In addition, I believe as both open-source and Frontier models progress, we will begin to improve performance for narrow tasks not via compute and model size scaling, but ingenuity around Agents and more, similar to what we’ve seen with Chain-of-Thought reasoning today. This likely will only be a boon for the operationalization of AI in a full-stack organization.

This playbook isn’t misunderstood, but it is under-appreciated and takes a certain alchemy of a founding team willing to integrate and adapt emerging technology while taking on the additional task of changing behaviors in an incumbent industry.

These teams are rarely from central casting of Silicon Valley.10

That said, our belief is that the operational risks of running these complex businesses will outpace the market-wide risks of revenue durability and stickiness of product as AI software providers churn through customers and try to infiltrate business models and organizations that may not be quite ready to adopt AI at scale.

If you’re working on a full-stack (or weird!) company and would like to chat, please reach out on twitter or email. You can find some of our theses here.

Also most startups fail.

We also have invested in enabling technologies of this thesis like SparkAI which John Deere acquired last year.

COVID created dynamics that made it net dominant to push into enterprise and be less “full-stack” for Ono (now Hyphen), however the learnings from this period were crucial in their R&D cycles and pace of iteration, making them one of the fastest food robotics companies to deploy in venture history.

Oddly some areas of bio is potentially the only ones where this isn’t the case as everyone wants to invest in the platforms. Though, many explored JVs to not own the *entire* stack.

Tbh this also is more of a problem of mega-funds which need to own 10-15% of a $10B+ outcome to return their oversized funds. That said, this does feel very much in their scope of needing maximally ambitious ideas.

Sam Altman frames this as “making any startup succeed takes a huge amount of pain and consumes your life, so you may as well just really go for it!”

A caveat here is that as the big tech companies have noticed this, they are more willing then ever to disrupt themselves, and thus you must be very very early to a category to beat them. That said, with M&A currently hamstrung, perhaps there is a new window.

Blake Robbins has a piece on this as it relates to other industries.

Keith Rabois has a famous pinned tweet related to this that helps understand his approach for OpenDoor and OpenStore.

Though there are definitely mafia effects forming around companies like Anduril and SpaceX.