Venture Capital to Innovation Capital

On the shift of venture capital investing strategies and how NFT funds could be an early signal for the next and potentially final shift in strategic positioning for venture investors

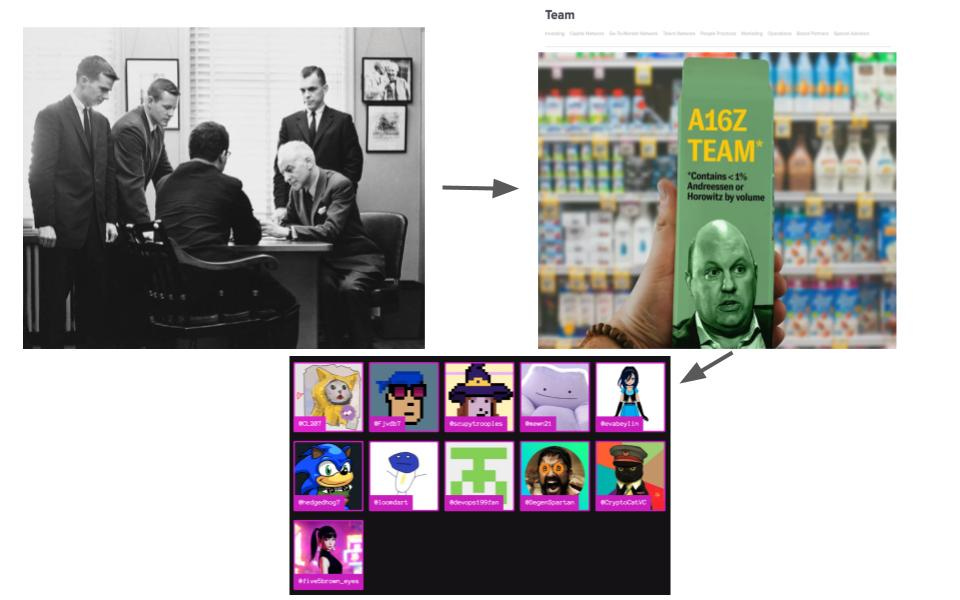

When you go back and look at the history of finance it is clear that in bull market cycles, institutions begin to agglomerate and attempt to bring more competencies under their umbrella. This has happened with investment banks and is now happening with what we traditionally have called Venture Capital.

At the early stages of many asset classes, there are specific funds that emerge that have conviction on the given asset class, and specific LPs that push forward this asset class differentiation narrative, as often LPs look to place managers into buckets based on risk profile, asset class, or other areas of focus (geography for example).

This happened with crypto in 2016, when we saw the rise of many crypto hedge funds and venture funds, often with very discrete strategies in their initial fundraising (we backed multiple of these at Compound in this time period, most notably Multicoin Capital and 1Confirmation) and happened once again in 2021+ as institutions set out to raise separate capital for earmarked for deploying into crypto asset managers.

What we saw back in 2016 (and perhaps 2021) was a clear understanding within the crypto asset class that there was material opportunity to "crossover" partially due to the differences of how projects launched (some opting to not raise private rounds of funding), while also because there was meaningful alpha in a still niche asset class for early managers to become "institutions" by attacking crypto with a multi-strategy approach.

In concert with this, traditional venture capital was going through its own cycle of stage-specific funds aiming to accumulate more capital and capture more alpha/beta by expanding into multi-stage firms. This has only progressed in that time period with the rise of crossover funds doing the same, expanding from public deeply into private markets.

Alongside the rise of DeFi and NFTs, a similar paradigm began to emerge, resulting in what is now multiple DeFi and NFT funds. I went as far as to openly solicit applications to personally (with a syndicate) back an NFT fund manager back in February 2021 and eventually became an LP in a larger institutional NFT fund.

All of these progressions are natural during a bull cycle when appetite is high and capital is abundant. It is my belief that this progression however is going to fundamentally shift the broader venture capital and illiquid asset class market. A shift from private market investing, to pure play innovation investing, with NFTs being the salvo shot to signal more of what's to come in more ways than one.

If we look at the history of venture capital, I would sum it up (very imperfectly) as progressing from we invest in small businesses (Greylock’s early investment in Filene’s Basement) to we invest in capital intensive businesses (semiconductor firms etc.) to we invest in high margin and low marginal cost businesses, to we invest in software to we invest in ~*technology*~ (whatever that means).

In today's world, technology is at the undercurrent of everything we do, and my bet is that technology as a concept will be the thing that creates the vast majority of inflection points in our world for the next many decades.

Technology, as we call it, is most recently responsible for disrupting and creating an inflection point in another asset class, the art market.

NFTs and Venture Funds

Over the past 18 months, multiple venture funds have started to invest in NFTs (to be clear, prior funds such as Variant, 1Confirmation, and others have done this), in many cases seeking LP approval to do so, just as we saw back in 2016-2018 when a variety of GPs (including myself) navigated LPA amendments to enable direct token purchases and/or SAFTs.

NFTs are ultimately viewed as part of the broader crypto ecosystem, operating as tokenized assets. While many of us believe that NFTs as a primitive will touch a variety of asset types, the vast majority of these funds are not structured around those assets versus illiquid visual assets and perhaps some community-driven, enabling assets (a la an NFT to be part of a DAO). That said, I don’t believe any other venture firm historically has talked to their LPs about buying traditional art, or other "fringe" illiquid assets. The argument for this is likely because the art market is one that requires a very specialized skill, in order to understand a very opaque and complex industry with multiple social and financial dynamics at play.

NFTs have all of these traits as well, but the core underpinning thus far has been the understanding of culture and technological impact on price, as well as a view on the asset class materializing over a long time horizon (dollars flow from physical art to digital art, and physical non-fungible assets to digital ones). This is something that VCs are theoretically uniquely equipped to do if they have spent time in crypto for a period of time.

VCs are (or should be) at the forefront of thinking about how the world is changing and living in the future in the most literal sense. Has our mandate from investors become loosened because we have proven to understand the idea maze and sequencing of the internet and its ripple effects better than ever before (software ate the world and VC accrued the value), or is it because we were in a bull market and many looked like geniuses? Probably both, as always.

The more important question to me related to NFTs is one of market maturity. In bull runs, schelling points around value, provenance, and long-termism become quite strong. Everybody believed in Punks just 18 months ago because of an agreed upon OGness. ArtBlocks were all grails that would stand the test of decades of time as the art world shifted into NFTs. Do we all believe this now? I’m not so sure.

With bear markets, investors have time to begin to parse value accrual dynamics to a given asset and often due to little new capital entering the space (and thus little upwards price pressure), schelling points around these assets are few and far between. Because of this, I believe the best NFT funds have to have very strong views on how valuation principles change for these assets over the next few years, and those investing under the played out thesis of “it’s like buying art from the renaissance” and “the earliest works will have long-term value once NFTs reach mainstream” will likely experience effectively random walks, especially as communities prove to be highly transient, with low barriers of entry and exit, and effectively no moat in a non-money printing environment.

While in bull runs it makes sense to expand asset classes on the way up to amplify any market alpha with strong market beta, in a bear market, divergence happens.

As with all business model innovations, there will be a collective that sticks to the tried and true model of investing in equity businesses, helping them grow and scale to massive size, and then exiting at some point. That is what VCs do, that is what our LPAs say we do, and that is what we do best and how we "add value".

There will also be a collective that says their tried and true model is investing in the future, parsing what the smartest people in the world believe and helping them navigate proverbial idea mazes, collections of futures, and value accrual because it is what they professionally do so they are better at it than most. We can debate the death of VCs in a decentralized world, but in reality it is just the shift of what VC means.

We ultimately are innovation parsing machines (or so we think) and thus the venture asset class perhaps is one that bifurcates into camps that believe we are investing in technology, to instead investing in innovation. The timeline only gets weirder from here, and as I said in a prior post:

Perhaps what will mark investing in risky asset classes in the 21st century won’t be the optimization of a specific process or approach, but instead the ability to be novel and adjust to these dynamics over time.

Venture Capital to Innovation Capital.