Robotics FOMO, Scaling Laws, & Technology Forecasting

What AI & Robotics forecasting means for startups and investors or...What tf are investors doing in AI and why?

Read my latest full post with footnotes on my website.

First off, happy summer to all celebrating.

Second, I wrote a long-form essay that looks at why tech investors and builders have gained conviction in robotics faster than any other new deep tech breakthrough I've ever seen.

The post talks through:

- A framework for technology forecasting

- How to think about seeing the present clearly (why this is wrong)

- Betting on scaling laws

- The other implicit and explicit bets people have made on first, second, and third order AI effects

- Why/How talent disperses after technological inflection points (and how capital affects this)

- Why VCs are FOMOing into robotics and much more.

Retweet it here, and read it here.

Robotics FOMO, Scaling Laws, & Technology Forecasting

A fairly profitable investment strategy in technology has always been understanding second-order effects of certain first-order inflection points. Put simplistically, IF X is probably happening, then Y could happen and thus if we believe the likelihood or scale of Y happening is higher than the broader market believes, we should speculate on Y.

A thinking of technology progression, derivative understanding, and imagination, generally.

But something has happened in the past few years that has potentially compressed the returns in this strategy and also has shifted dynamics of how these next-order effects and resulting emerging categories get capitalized and how companies can build advantages.

The lens of AI and the rise of attention and consensus within Robotics specifically is a good lens in which to view this change through.

THE FALLACY OF SEEING THE PRESENT CLEARLY & ALPHA OF PREDICTING THE FUTURE

There’s a recent Lesswrong post that looked at the concept of higher order forecasts and broke them down from ground truth all the way to Third-Order Forecasting which gives a decent framework for how to think about parsing changes in technology markets and startup investing.

For my entire career, I have largely tried to think about how to build an investment firm surrounding the idea of identifying and speculating on future inflection points and using these learnings to then capture value from having a nuanced and precise view on the cascading effects that result from the change. We (Compound) build out a collection of futures we believe in and use capital and time to help brilliant people accelerate and/or materialize those forecasted futures.

We’ve built many frameworks and processes internally around forecasting both at a higher level of technology development as well as more granular levels of industry and societal development. This has, at times, led to public-facing research such as A Crypto Future, in which we reasoned year-by-year about how the crypto would change as an industry and how the world would change around crypto.

Despite my conviction in this approach, there have always been screams from many other VCs that predicting the future was incorrect, with many pointing to the most bastardized quote in all of venture, said by the legend Matt Cohler: “Our job as investors is to see the present very clearly, not to predict the future.”

I have loudly debated the nuance of this statement as an alpha generating strategy at the early stage and have only gained conviction in this stance in a world in which there are more than a few venture firms with over $100M who all know each other and collaborate (like the world used to be).

I would argue to see the present clearly today means to pay 75-200x+ ARR ahead of any durable product-market fit on a term sheet that sits alongside 4-6 others, or it means you will sneak in a small check that won’t meaningfully impact fund performance. This may work for some in building a single beta-catching fund, but I don’t believe one can build a consistently alpha-generating firm in this dynamic anymore.1

Because of this return-compressing dynamic, a large number of investors spend their lives frantically looking to understand what is slightly next while abandoning what feels slightly over. This is partially because the forecasting of simplistic adjacencies is easy to rally a partnership around, easy to sell LPs on, and easy to gain conviction on quickly because you feel a bit smarter than simplistic first-order thinkers who just bet on the perceived leaders in a given space.

However, as this post is focused on the early-stage, what this often means is that in order for this to be the right strategy, the early perceived leaders must persist. This is an open question in highly competitive and crowded (consensus) areas where because of the scale of capital in private markets today, it often takes many years to see compounding breakaway moats.

This style of investing also has mature frameworks that VCs love to pattern match against. Things like selling pickaxes during a gold rush and transitioning industries from asset-heavy to asset-light while capturing the same value as asset-heavy approaches. Investors are in theory isolating variables and minimizing the need to be correct on various sequentially tied together futures, which is very hard.

And then there are incentives, which means this is a wildly profitable strategy on paper.

Investors stay one step ahead of the capital stack that looks to the prior stage as the “known universe” for investing and capture mark ups in years 1-4 as they raise new funds in years 3-5, ad infinitum, with either a win, a new story to tell (I know fund 3 blew up but this NewCo that got marked up in fund 4 is a monster) or with a bunch of fees such that the un-levering/churn of their LP base means they go from making tens of millions of dollars per year down to single digit millions, over a 20 year timespan.2

This works until it doesn’t, of course, but by then the only thing in a worse spot is potentially an investor’s legacy (and maybe LPs’ wasted opportunity cost).

AI AND FORECASTING

As AI has continued to progress, we have begun to have many ground truth and first-order effects work their way into the market that has caused large amounts of “conviction”.3

Alongside this has come a level of consensus wisdom that has proliferated through both sides of the market (builders and investors). This started with people directly associating model parameter size with quality, which caused many to dig in a layer deeper and progress to understanding the most notable concept of Scaling Laws. Scaling Laws becoming a common nomenclature amongst investors from 2022 to 2024 has now led to people looking at this concept as a global truth and applying it to other adjacencies…like robotics.

This has led to the fastest Schelling point resulting from “second-order forecasting” I have ever seen in venture capital.

How did this happen?

Again, using the prior forecasting framework and applying it to AI is instructive to understand what has happened within the adjacency of robotics and the explicit bet that is driving investors’ blind optimism.

It is important to remember that forecasting has various degrees of consensus built in and this is a non-exhaustive list of the most obvious and most consensus forms of forecasting, shown by both the implicit and explicit bets that investors and founders are making on AI progression.

0 ORDER-FORECASTS (GROUND TRUTH)

GPT-4 is a highly performant LLM and multimodality is working as well.

Compute and data is needed to scale LLM performance (we can debate whether scaling laws will hold etc. but just take this as ground truth)

With these ground truths in place we then can look at some various forecasts and the resulting behaviors based on how people view them.

1ST-ORDER FORECASTS

What is the chance that somebody can unseat OpenAI as the leading frontier model developer?

This caused a bunch of people to deploy money into both OpenAI and also to all the other new labs like Anthropic, Mistral, etc. albeit with somewhat different theses for each. People were betting on everything across commoditization curves, the transfer of “secrets” being the core IP in AI labs (not the actual technology), an uptake of sovereign models, and much more.

Who are clearest immediate beneficiaries of AI model performance increases?

This caused people to long hyperscalers, some of which took longer than others for people to build conviction on. Meta was a clear beneficiary as they had products that could generate cash flow at higher efficiency from AI broadly, they benefitted from the commoditization of models, and they had accumulated large-scale compute.

Alphabet was a slower beneficiary as people were overly focused on the lost lead in AI despite largely being the most competent AI organization of the past decade+.

Microsoft was the most obvious trade with both distribution as well as a theoretical stranglehold on OpenAI (the Apple news maybe sheds some doubt on this).

Meanwhile, narratively Apple was moving too slow and was done and then everyone seemed to remember that they have insane local compute penetration/distribution and the stock went up $300B+ on some AI demos courtesy of Apple AI + OpenAI.

And now with companies like Adobe guiding up at earnings (and seeing material stock price appreciation because of it) investors are starting to look at a rotation of value creation from hyperscalers to more vertically-focused companies as the dust begins to settle on understanding a small amount on enterprise advantage accumulation of AI after initially worrying about broad-based destruction.

What industries can existing AI models serve well?

This is perhaps the most important first-order forecast for VCs and founders. This has led to what I would euphemistically call an aggressive funding of low-hanging fruit within the AI ecosystem and a dynamic where you have a large number of companies targeting the high-level use-cases of legal, research, accounting, marketing, and more.4

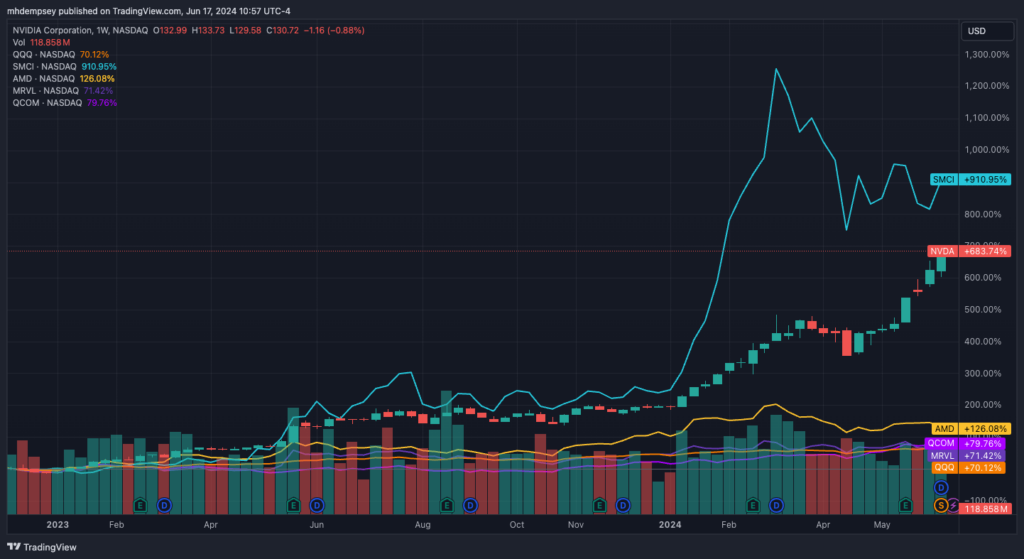

Who makes GPUs and will the supply/demand imbalance persist?

This caused people to long Nvidia and then adjacencies like SuperMicro (SMCI) and many others with haste while speculating on who was offside and would transfer market cap from incumbent to upstart (more on this later).

2ND-ORDER FORECASTS

As we work our way through these we start to understand the derivatives of these first order implications. This is why I even started to write this schizophrenic post…