On My Mind - #6

Animation is eating the world | Commoditization in machine learning | Starting your career in Consumer VC | ML + Animals

On My Mind - by Michael Dempsey

This email spawns from this thread. The process for this will evolve but as you'll see, some thoughts are random, and most are unfiltered or barely edited. Either way, let me know what you like, don't like, or want to talk about more.

Two self promotion thoughts this time!

I was on Erik Torenberg’s podcast (#5).

Main Thoughts

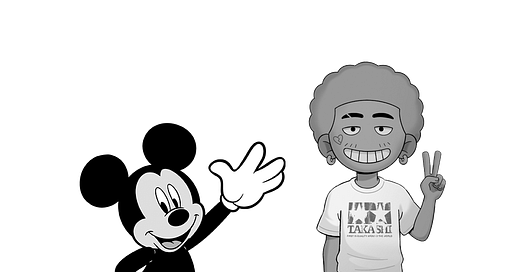

1) Animation is Eating The World

I wrote something on the history of animation, the future of animation, and how different technological breakthroughs have had profound effects at various points in time. This newsletter is focused on animation because I wrote something really long about it. My main view is that animation is vastly undervalued, under appreciated, and on the brink of a new explosion of content that is incredibly valuable to many stakeholders. This piece is a result of lots of research and conversations and copious notes. It’s a long read, but one that I think has lessons that apply to multiple different industries within both tech broadly, consumer specifically, and media of course.

The website I built for the piece is slow to load, but I think visually important to read on, so please wait the full ~10-20 seconds for it to load. Again, it’s a long read so feel free to use the table of contents to skip around and read what interests you.

Also please share it!

2) We have both heavily overestimated and underestimated the commoditization curve in machine learning.

We underestimate ML in certain areas and drastically overestimate it in others, leading to deaths of companies innovating due to the commoditization curve (object recognition as a service companies), and others dying betting on the commoditization curve that never came (Jibo). This has made it incredibly difficult for founders in the ML space to understand what investors want, and for investors to understand what is truly defensible and won’t be pushed down to a near free, general-purpose but horizontal model.

We as investors say hand wavy things like “ability to acquire proprietary datasets” for some vertical ML applications but increasingly areas have shown that this isn’t as advantageous or defensible as some believe. I’m incredibly interested in reading an updated take on Google’s One Model to Learn Them All paper.

Increasingly I’ve distilled my view on some defensibility as an understanding/elite ability to do research adaptation (and then expansion) into a commercializable product. While this sounds simple, it requires a pretty complex blend of research brain and production brain founders that are rare.

Related - It's been fascinating seeing how the "minimum viable implementation" of ML can stay strong for a really long period of time where 10x implementations don't cause any excitement. This specifically I'm thinking of neural style transfer and how applications like Prisma took early steps at this and wow'd consumers (for a brief time). Now we're seeing increasingly scalable or transferrable and bleeding edge research related to this that few people would care about or notice.

3) Is specializing in Consumer early in your VC career a bad idea?

I originally thought the best advice for new VCs is to not do consumer, but now I'm not 100% sure. It may be smart to do consumer because you'll get a super fast feedback loop (though ability to sift signal vs. noise as to why something worked in short-term but didn't generate a long-term valuable business is tough). My early thought as to why you don't do consumer (specifically consumer social or digital consumer businesses) is because the failure rate is just significantly higher/faster, with little process or understanding of failures vs. wins, and often a difficult to support investment thesis if the company fails.

It could be dominant to do consumer though as a junior VC if you can capitalize on a few hot, early deals and then leverage that into a more stable, longer-term role, before your consumer company burns out or sells in a premium acqui-hire.

Within non-digital consumer (think consumer brands/CPG and even consumer healthcare products), we’ve seen an ability to build single-digit $M/year businesses occur at a faster rate, but it’s still incredibly difficult to break past that $10-$20M/year ceiling. I haven’t heard an incredibly compelling vision as to how to understand those types of companies vs. capped-upside companies from some of the elite consumer investors. There’s an argument to be made that for D2C businesses, you’ll have a lower failure rate so you won’t have to burn as much capital making mistakes early on (though in reality, a 1x isn’t too different from a 0x when it comes to burning capital). The issue is, you will also probably have lower upside, so if you’re doing these investments in the scale of a traditional technology VC firm, your results may not be as valued or matter vs. a firm built around the dynamics of D2C businesses. And the lower failure rate today (paired with larger funds that need to pour $$ into companies) can lead to overpriced early rounds with small signs of traction, as full-stack VCs (more on them later) can see an avenue to quickly putting tens of millions of dollars to work on CAC).

On the consumer digital side, many firms seem to be sticking to the playbook of wanting to play the call-option game (write tiny seed checks into companies out of a $250M+ fund with the hopes of leading their A), but I don't know if that really works in a highly competitive series A+ environment.

This may be all a moot discussion though as I’m not sure being a horizontal “consumer investor” means the same thing anymore/is possible at an individual level. What I mean by this is that post-facebook/twitter/zynga/snap we had a rush of people wanting to find the next mobile consumer social win, which led to bets on companies like Houseparty/Meerkat, Secret, Whisper, Peach, and more (I don’t think any of these companies returned a fund, except maybe a Discord, which could but is a fundamentally different product). Now however the explosive consumer companies have looked more like Uber/lyft, bird/lime, hims/Ro, Allbirds, and some others i'm forgetting. I’m not sure it’s the same profile of investor (or even common thread between companies) that will see and get excited by all of those at seed enough to lead. Bird/Lime will feel complex and capital intensive to an investor that loves Hims/Ro’s ability to instead spend their VC money on digital acquisition. Allbirds’ upside will feel capped or moat will feel weak compared to Hims/Ros recurring nature and ability to go incredibly horizontal. Hims/Ro will feel like a regulatory risk down the road to Allbirds’ responsible brand and clear ability to become the next big shoe company, etc.

Back to the point about call-options, I will say that I'm confident that having a mandate to spray and pray at consumer seed is probably the worst of both worlds. Many full-stack firms have started to do this and while you may get some early founder face time with a now-hot series A consumer deal, I'd be surprised if it leads to a meaningful win-rate at A rounds (does anyone want to share data?).

There are a lot of dynamics at play here that I’ve written horribly about above, so let’s get back to the core question of is doing consumer dominant early on for your career in VC? The answer is, it depends. A less cop out answer could be: If you’re a new GP who is now going to be measured on the economics/returns you bring into the fund and you have 2 funds to prove it, maybe not. But if you’re a junior person looking to parlay a brand elevation into a better role (or learn quickly and get out of venture), maybe so.

4) Applying deep learning to identify patterns in animal behavior could lead to new understandings of how they work.

This paper digs into detecting pain of horses via DL. You can start to see a slope where we end up being able to better understand animal health and preference through patterns, similar to how we can identify these things visually in humans with enough pattern recognition (although thus far computer vision and deep learning have proven quite poor at truly understanding emotion from visual cues alone). Nothing concrete here but an interesting rabbithole to go down in academia and an even more interesting future to imagine where we both communicate with animals or have a much deeper understanding of them.

5) I did my first podcast since 2015. I need to be better at this.

I went on Erik’s podcast (listen here) and discussed a bunch of things that I care about including machine learning, robotics, family planning/women’s health, animation, gender fluidity, and more. I definitely spoke too fast and used the word “like” too much but it was a lot of fun. We didn’t go aggressively deep into each of the topics but if you have any thoughts or want to further discuss, feel free to email me or tweet at me and happy to!

Other papers/things I’ve read

Generating 3D models of clothing from 2D Images - There are multiple obvious use-cases for this research, but the maybe under-the-radar one is for use on avatars and digital celebrities. One of the bigger issues people likes CJW (creator of Shudu) has talked about is creating digital clothing. Miquela has historically had similar problems and thus their approach has been often not digitally recreating the clothing at all.

A dataset for facial recognition in cartoons - Here are some thoughts I tweeted related to this. TLDR is that while these results actually weren’t great, it’ll be interesting to see more datasets emerge surrounding cartoons, as I wrote about 4 issues ago.

FaceSpoof Buster - This paper is another in a string that I have continued to read and catalogue related to either tricking facial recognition systems, or identifying the various types of spoofs within them. If you’re interested in this topic I’d recommend reading through some of the related works within this paper.

If you have any thoughts or feedback feel free to DM me on twitter. All of my other writing can be found here.