Expected Value In Crypto & Building Infinite Blockspace

There is an overabundance of people building new L1s/L2s/LSTs & other infrastructure...and an undersupply of people attempting to build new applications in crypto.

The full essay with footnotes is available on my website.

Feel free to share here.

I recently re-read three fantastic (and imo canonical) older crypto posts that shaped a lot of how people think about value capture in crypto (Fat Protocols, Thin Applications, and Crypto Tokens and the Coming Age of Protocol Innovation).

The original fat protocol thesis is well understood in terms of L1 value accrual, but it also meant that you saw a more long-tail dynamic within Dapps, which meant less of a power law from a % chance of success perspective (i.e. many tokens will be worth *something* while few go to 0, as I wrote about previously).

What we see in bull markets (and perhaps crypto in general) is a shift of how people look at Expected Value.

This leads us to a logical conclusion today where the majority of builders view the maximum EV thing to do is build new L1s or L2s instead of Dapps or application-centric protocols, leading to a world of further fragmentation and plentiful useless blockspace. They then take a step down and build abstractions to siphon off some the L1/L2 value in things like LSTs.

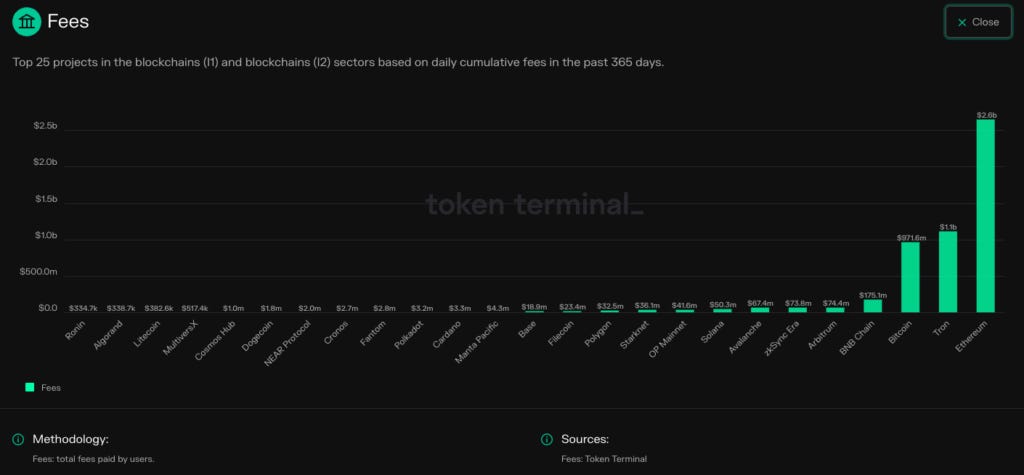

Some may make the argument that this dynamic is because of the fee structures and “defensibility” of blockspace relative to Dapps in crypto. As shown in the data above, L1s and L2s make up the majority of cumulative economic value capture in crypto today. This, along with deeper analyses of the business models of blockspace, explains the massive FDVs for a variety of L1s like Ethereum (and more actually to this point, things like insert zombie L1 here)1 and to a lesser extent dominant L2s like Arbitrum2, and also plays into the terminal network premium that crypto protocols get where speculators are willing to model network scale and penetration many years into the future and pay for that today, resulting in high multiples.

That said, this is somewhat disproven in utility when you look at the trailing 365 day fees across all protocols on Token Terminal, with a variety of DeFi Protocols outpacing far higher-valued blockspace.

Of course, fees in 2024 are not a perfect measure as there are many other determinants to value including defensibility, terminal scalability, net profitability of a protocol, and even theoretically the token’s ability to capture this stream of capital.

We saw the latter recently get its first test with the proposal to turn on UNI fee accrual and a wave of other DeFi protocols trading up quickly in concert with this as markets re-rated the likelihood of “valueless governance tokens” capturing tangible value.

So yes, blockspace is a good business (and perhaps a clean business with lower regulatory barriers), but if we peel back the veil of ignorance, the reality is, there is a flywheel, or perhaps a vicious cycle of perverse incentives between founders and investors today that lead to the everlasting creation of blockspace.

THE LARGE FUND PHENOMENON

Investors raise larger funds with the need to deploy larger sums of capital in search of increasingly large returns. This strategy is easiest to run via investing in capital-intensive projects3. All of that capital needs to find returns that can justify billions of dollars of FDV being created and getting liquid.

We can look at the top 100 tokens by market cap and see the red representing tokens that fall within this framework. As one can see, there are very few protocols that are worth billions of dollars that aren’t effectively new types of block space, or siphoning off infrastructural value. The story doesn’t get much better if you use FDV instead of market cap.

For someone like me (and our firm Compound) who wants to see the long-term promises of crypto matter in the world, I believe this cycle of VC and Founder blockspace inflation will erode the ecosystem (some could argue it already has) and likely lead to even louder monolithic vs. modular chain -esque debates that don’t actually matter, and result in little progress.