Category Creation & Capital in Technology + Potential Market Tops

A breakdown of how capitals flow through markets and why we continually see a strong desire to create categories within each cycle of technology.

This full post with footnotes can be read on my personal website.

See below for a preview and share the post on twitter.

I believe one of the most damaging pieces of advice to proliferate in the tech world over the past few years has been “being early is indistinguishable from being wrong”.

There are many reasons why this is true in theory but as I’ve talked about for years, at this stage of technology development and penetration, whether you’re a technologist or capital allocator, if you’re not too early, you’re too late.

As venture markets continue to institutionalize, this becomes more true with consensus startups getting rampantly bid up in price. This leads to a compressing of returns and forces growth-stage investors to have asymmetrically upside-skewed beliefs on terminal outcomes in order to capture meaningful alpha.

Concurrently, technology as an asset class has continued to evolve and is now going through a next major wave that could lead to market cap dislocation at a far faster pace and grander scale than this past decade.

Put simply, if the prior decade of technology as an asset class was about incumbent industries being swallowed up by tech, leading to an expansion of the market cap of “tech” as a category, than the next may be about disruption and market cap destruction within tech itself.

What this means is that there will be parallels of businesses that are “tech” versus “non-tech” versions as well as “new tech” versus “old tech” versions. With this dynamic comes a necessity to create legibility in order to properly (or improperly) analyze and value these new types of technology businesses. People do this by changing the terminology and descriptors surrounding these companies, a cycle that continues to happen over and over again.

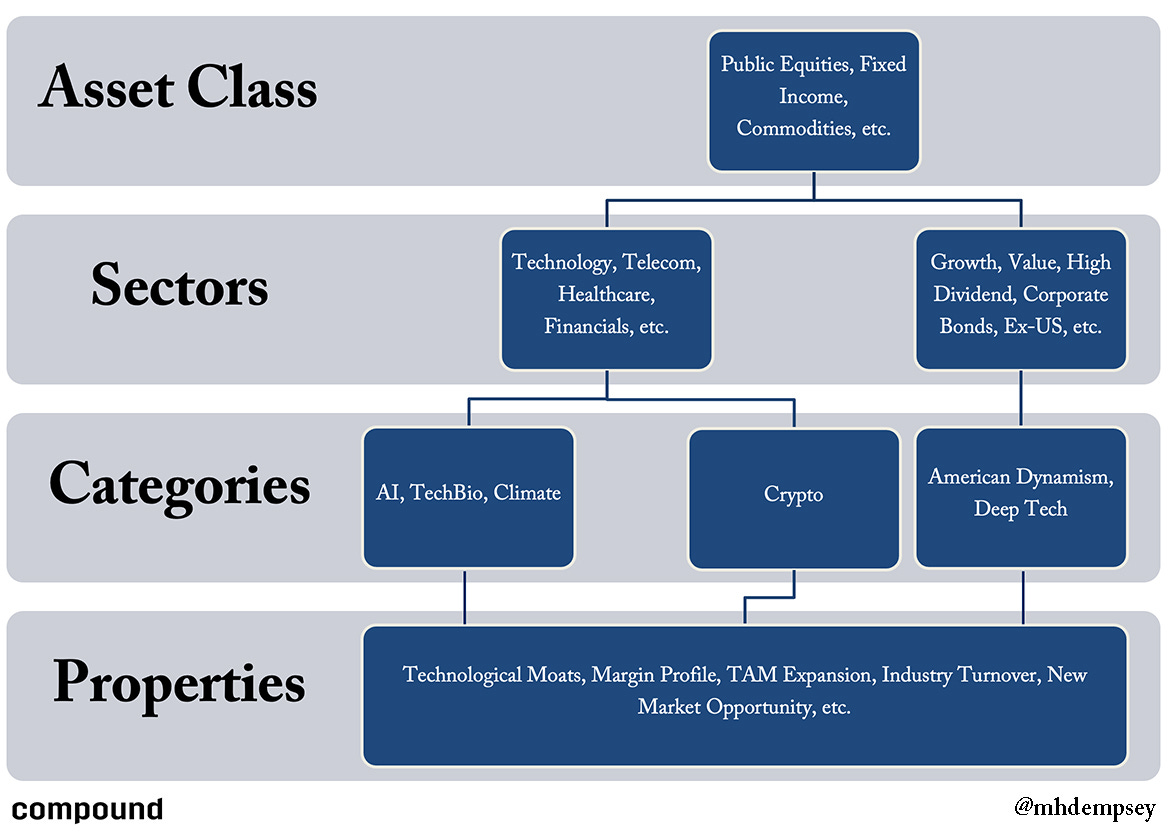

How Capital Flows Through Assets

At a high level, category creation occurs as an exercise to draw in capital, create legibility, and then create novel re-rating or “multiple expansion” of an opportunity.

The chart below details this entire dynamic.