Are crypto returns less power law driven moving forward?

A look at data to understand whether crypto returns will follow more of a normal distribution as the industry matures.

To read this full post with footnotes, click here.

Power laws rule everything around us. This is a core principal of what we have largely come to learn in a world dominated by this narrative, which has also helped proliferate the concept of Asymmetric Upside.

Within traditional tech/Web2, due to the compounding nature of moats (most notably network effects) and duopolistic markets, it is often assumed that outcomes follow a colloquial power law distribution in which the top ~5-10% of outcomes will outweigh the value created by the next ~90% of outcomes.

Tech companies have historically accumulated value at an astounding rate and scale, one that has surprised even the brightest tech investors over the past 5-7 years. This is due to both the structural advantages that (often) closed-source, walled garden, platform companies that continue to accumulate horizontal scale are able to benefit from, in addition to the financing dynamics within tech leading to fairly binary outcomes as public markets have often been reserved for a certain scale and risk level of companies.

The Fat Protocol thesis was a good framework to understand value accrual in the early days of crypto and has proven to be very true, with layer 1 protocols accumulating much of the value. However as crypto as an industry matures and tokenization has been adopted as the dominant value capture and marketing tool, it is my belief that we could see this power law dynamic, a dynamic which serves institutional investors largely, begin to be less true.

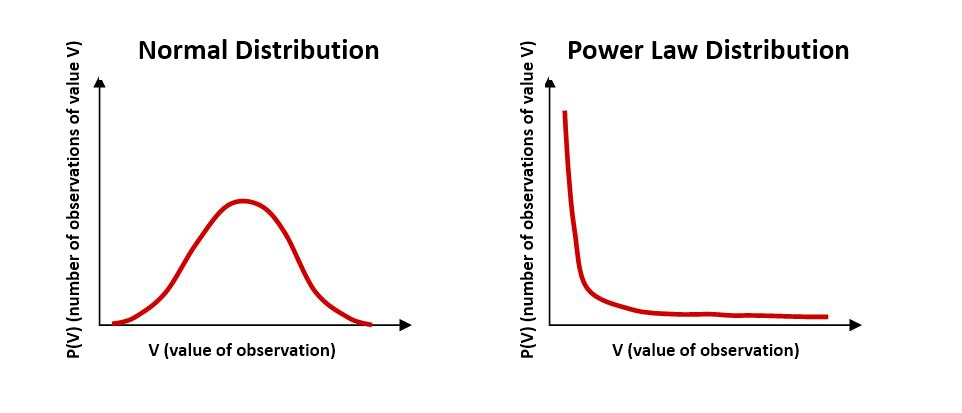

Put more specifically, the value accrual of crypto protocols today and tomorrow may follow more of a normal distribution than power law distribution. There are a few reasons:

The open-source nature of crypto means that forking and vampire attacks can occur once a certain level of product-market fit is achieved. This allows for incremental iteration to capture meaningful value via a fork, effectively spitting in the face of the Web2 mindset that 10x or 100x products are needed to win.

The fast value accrual creates incentives that often don’t lead to sustainable moats being created within crypto protocols. In DeFi Summer we saw large amounts of wealth generated via yield farming and a larger bull run in crypto token prices. This paired with general unsophistication of how we analyze revenue or business durability, and thus metrics, caused DeFi protocols to trade at insane multiples in reality, along with ponzi dynamics that caused large scale buying. In Crypto, due to the lack of aforementioned mid to long-term moats, founders and communities must continue to evolve their product due to lack of compounding of existing success and network effects (again, due to point #1). Put more bluntly, once a core team has amassed millions to billions in wealth and the token has been farmed and dumped, it’s hard for projects to have incentives to work through a second bear cycle or downturn and break the next step function of network value.

Tokens as arenas for PVP trading. There are a number of tokens today that carry network values of $50-$500M with decent liquidity depth that effectively act as playgrounds for traders, almost regardless of the underlying asset. This dynamic allows investors at moderate scale to exit their position either slowly or in tranches despite very little network activity or usage of the underlying protocol. In Web2 these companies just die due to inability to raise new venture financing, in crypto they exist as zombies on your CEX of choice in perpetuity.

Related to the last point on #3, the universe of buyers for these assets is massively larger than private technology companies. This creates price discovery in both directions that private markets don’t have.

To put some admittedly shoddy data around this, I quickly pulled all tokens from CoinGecko, removed L1s, L2/sidechains, Meme, and low trading volume tokens in order to see how distributions of outcomes would look. I did this specifically as IMO L1s would skew all data that is meant to be forward looking and largely do follow a power law and will for some time, and meme tokens shouldn’t be invested in on the institutional side.